TrendLine Saskatchewan - January 2019

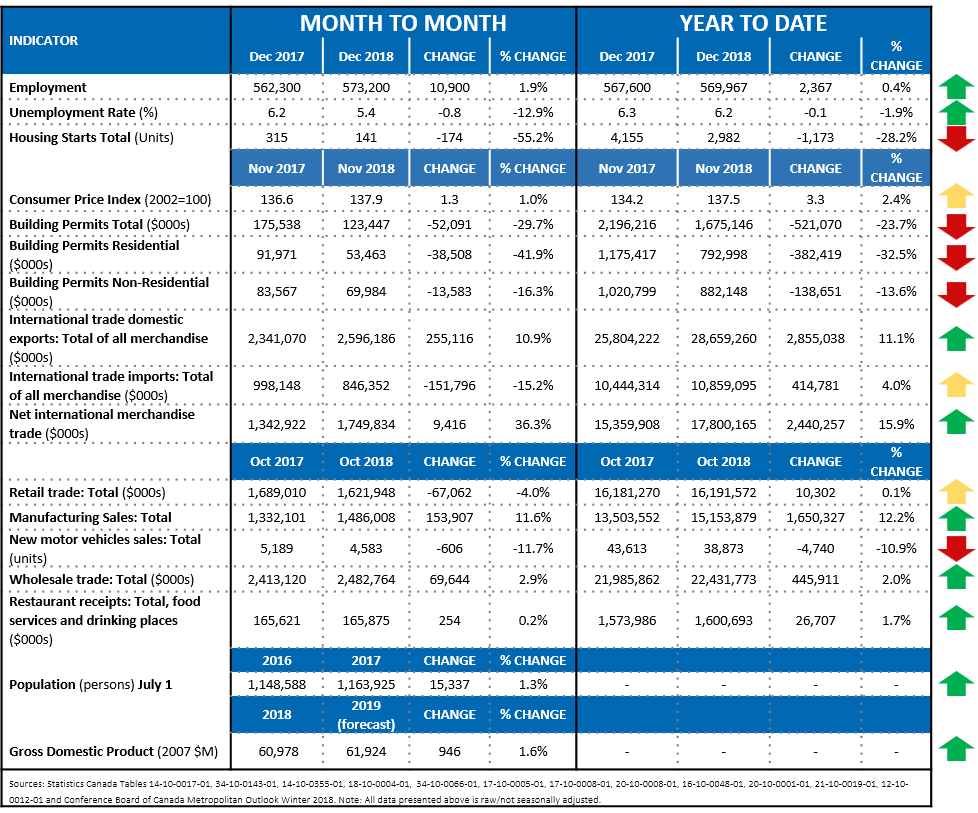

Average year-to-date employment and restaurant receipts are up and the unemployment rate is down.

Housing starts, building permits, and new motor vehicle sales are down while manufacturing sales, exports, wholesale trade, restaurant receipts, and retail trade are up, with percentage increases in retail trade at 0.1% lagging well behind the rate of inflation.

TrendLine Saskatchewan - January 2019

Average year-to-date employment and restaurant receipts are up and the unemployment rate is down.

Housing starts, building permits, and new motor vehicle sales are down while manufacturing sales, exports, wholesale trade, restaurant receipts, and retail trade are up, with percentage increases in retail trade at 0.1% lagging well behind the rate of inflation.

Composite Indicator Actual & Seasonally Adjusted

Key Indicator This Month

|

Employment 569,967 |

|

|

Up 0.4% Year to Date |

Employment

569,967

Up 0.4% Year to Date