COVID-19 Labour Market Impacts - August 2020

A detailed analysis of how the COVID-19 pandemic has impacted Saskatchewan

Coronavirus disease 2019 (COVID-19) is an infectious disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). It was first identified in December 2019 in Wuhan, Hubei, China, and has resulted in an ongoing pandemic. The first confirmed case has been traced back to 17 November 2019 in Hubei. Traces of the virus have been found in wastewater that was collected from Milan and Turin, Italy, on 18 December 2019.

The World Health Organization declared the COVID-19 outbreak a Public Health Emergency of International Concern on 30 January 2020, and a pandemic on 11 March 2020.

On 31 January 2020, Italy had its first confirmed cases, two tourists from China. As of 13 March 2020, the WHO considered Europe the active centre of the pandemic. On 19 March 2020, Italy overtook China as the country with the most reported deaths. By 26 March, the United States had overtaken China and Italy with the highest number of confirmed cases in the world. Research on coronavirus genomes indicates the majority of COVID-19 cases in New York came from European travelers, rather than directly from China or any other Asian country. Retesting of prior samples found a person in France who had the virus on 27 December 2019 and a person in the United States who died from the disease on 6 February 2020.

As of 27 July 2020, more than 16.4 million cases have been reported across 188 countries and territories, resulting in more than 650,000 deaths. More than 10.0 million people have recovered. The United States, Brazil and India now lead the global case count.

The virus is primarily spread between people during close contact, most often via small droplets produced by coughing, sneezing, and talking. The droplets usually fall to the ground or onto surfaces rather than travelling through air over long distances. However, research as of June 2020 has shown that speech-generated droplets may remain airborne for tens of minutes. Less commonly, people may become infected by touching a contaminated surface and then touching their face. It is most contagious during the first three days after the onset of symptoms, but spread is possible before symptoms appear, and from people who do not show symptoms.

Fever is the most common symptom of COVID-19, but is highly variable in severity and presentation, with some older, immunocompromised, or critically ill people not having fever at all. In one study, only 44% of people had fever when they presented to the hospital, while 89% went on to develop fever at some point during their hospitalization.

Other common symptoms include cough, loss of appetite, fatigue, shortness of breath, sputum production, and muscle and joint pains. Symptoms such as nausea, vomiting, and diarrhea have been observed in varying percentages. Less common symptoms include sneezing, runny nose, sore throat, and skin lesions. Some cases in China initially presented with only chest tightness and palpitations. A decreased sense of smell or disturbances in taste may occur. Loss of smell was a presenting symptom in 30% of confirmed cases in South Korea.

As is common with infections, there is a delay between the moment a person is infected and the time he or she develops symptoms. This is the incubation period. The typical incubation period for COVID‑19 is five or six days, but it can range from one to fourteen days with approximately ten percent of cases taking longer. Some infected people have no symptoms, known as asymptomatic or pre-symptomatic carriers; transmission from such a carrier is considered possible. As at 6 April, estimates of the asymptomatic ratio range widely from 5 to 80 percent.

Symptoms of COVID-19 can be relatively non-specific; the two most common symptoms are fever (88 percent) and dry cough (68 percent). Less common symptoms include fatigue, respiratory sputum production (phlegm), loss of the sense of smell, loss of taste, shortness of breath, muscle and joint pain, sore throat, headache, chills, vomiting, coughing out blood, diarrhea, and rash.

The outbreak is a major destabilizing threat to the global economy. Agathe Demarais of the Economist Intelligence Unit has forecast that markets will remain volatile until a clear image emerges on potential outcomes. One estimate from Washington University in St. Louis gave a $300+ billion impact on the world's supply chain that could last up to two years. Global stock markets fell on 24 February due to a significant rise in the number of COVID-19 cases outside China. On 27 February, due to mounting worries about the coronavirus outbreak, U.S. stock indexes posted their sharpest falls since 2008, with the Dow falling 1,191 points (the largest one-day drop since the financial crisis of 2007–08) and all three major indexes ending the week down more than 10 percent. On 28 February, Scope Ratings GmbH affirmed China's sovereign credit rating but maintained a negative outlook. Stocks plunged again due to coronavirus fears, the largest fall being on 16 March. Many consider an economic recession likely.

Lloyd's of London has estimated that the global insurance industry will absorb losses of US$204 billion, exceeding the losses from the 2017 Atlantic Hurricane season and 9/11. The COVID-19 pandemic will likely be the costliest disaster in human history.

Tourism is one of the worst affected sectors due to travel bans, closing of public places including travel attractions, and advice of governments against travel. Numerous airlines have cancelled flights due to lower demand, and British regional airline Flybe collapsing. The cruise line industry was hard hit, and several train stations and ferry ports have also been closed. International mail between some countries stopped or was delayed due to reduced transportation between them or suspension of domestic service.

The retail sector has been impacted globally, with reductions in store hours or temporary closures. Visits to retailers in Europe and Latin America declined by 40 percent. North America and Middle East retailers saw a 50–60 percent drop. This also resulted in a 33–43 percent drop in foot traffic to shopping centres in March compared to February. Shopping mall operators around the world imposed additional measures, such as increased sanitation, installation of thermal scanners to check the temperature of shoppers, and cancellation of events.

Hundreds of millions of jobs could be lost globally. More than 40 million Americans lost their jobs and filed unemployment insurance claims. According to a United Nations Economic Commission for Latin America estimate, the pandemic-induced recession could leave 14–22 million more people in extreme poverty in Latin America than would have been in that situation without the pandemic.

Coronavirus fears have led to panic buying of essentials across the world, including toilet paper, dried and/or instant noodles, bread, rice, vegetables, disinfectant, and rubbing alcohol.

Governments across the country are spending unprecedented amounts in response to the COVID-19 pandemic. However, new spending is only making up a fraction of the damage the novel coronavirus is doing to the Canadian economy.

Parliamentary budget officer Yves Giroux's estimates that the various measures to help those affected by the pandemic will add up to nearly $146 billion in new federal government spending.

COVID-19 Labour Market Impacts - August 2020

A detailed analysis of how the COVID-19 pandemic has impacted Saskatchewan

Coronavirus disease 2019 (COVID-19) is an infectious disease caused by severe acute respiratory syndrome coronavirus 2 (SARS-CoV-2). It was first identified in December 2019 in Wuhan, Hubei, China, and has resulted in an ongoing pandemic. The first confirmed case has been traced back to 17 November 2019 in Hubei. Traces of the virus have been found in wastewater that was collected from Milan and Turin, Italy, on 18 December 2019.

The World Health Organization declared the COVID-19 outbreak a Public Health Emergency of International Concern on 30 January 2020, and a pandemic on 11 March 2020.

On 31 January 2020, Italy had its first confirmed cases, two tourists from China. As of 13 March 2020, the WHO considered Europe the active centre of the pandemic. On 19 March 2020, Italy overtook China as the country with the most reported deaths. By 26 March, the United States had overtaken China and Italy with the highest number of confirmed cases in the world. Research on coronavirus genomes indicates the majority of COVID-19 cases in New York came from European travelers, rather than directly from China or any other Asian country. Retesting of prior samples found a person in France who had the virus on 27 December 2019 and a person in the United States who died from the disease on 6 February 2020.

As of 27 July 2020, more than 16.4 million cases have been reported across 188 countries and territories, resulting in more than 650,000 deaths. More than 10.0 million people have recovered. The United States, Brazil and India now lead the global case count.

The virus is primarily spread between people during close contact, most often via small droplets produced by coughing, sneezing, and talking. The droplets usually fall to the ground or onto surfaces rather than travelling through air over long distances. However, research as of June 2020 has shown that speech-generated droplets may remain airborne for tens of minutes. Less commonly, people may become infected by touching a contaminated surface and then touching their face. It is most contagious during the first three days after the onset of symptoms, but spread is possible before symptoms appear, and from people who do not show symptoms.

Fever is the most common symptom of COVID-19, but is highly variable in severity and presentation, with some older, immunocompromised, or critically ill people not having fever at all. In one study, only 44% of people had fever when they presented to the hospital, while 89% went on to develop fever at some point during their hospitalization.

Other common symptoms include cough, loss of appetite, fatigue, shortness of breath, sputum production, and muscle and joint pains. Symptoms such as nausea, vomiting, and diarrhea have been observed in varying percentages. Less common symptoms include sneezing, runny nose, sore throat, and skin lesions. Some cases in China initially presented with only chest tightness and palpitations. A decreased sense of smell or disturbances in taste may occur. Loss of smell was a presenting symptom in 30% of confirmed cases in South Korea.

As is common with infections, there is a delay between the moment a person is infected and the time he or she develops symptoms. This is the incubation period. The typical incubation period for COVID‑19 is five or six days, but it can range from one to fourteen days with approximately ten percent of cases taking longer. Some infected people have no symptoms, known as asymptomatic or pre-symptomatic carriers; transmission from such a carrier is considered possible. As at 6 April, estimates of the asymptomatic ratio range widely from 5 to 80 percent.

Symptoms of COVID-19 can be relatively non-specific; the two most common symptoms are fever (88 percent) and dry cough (68 percent). Less common symptoms include fatigue, respiratory sputum production (phlegm), loss of the sense of smell, loss of taste, shortness of breath, muscle and joint pain, sore throat, headache, chills, vomiting, coughing out blood, diarrhea, and rash.

The outbreak is a major destabilizing threat to the global economy. Agathe Demarais of the Economist Intelligence Unit has forecast that markets will remain volatile until a clear image emerges on potential outcomes. One estimate from Washington University in St. Louis gave a $300+ billion impact on the world's supply chain that could last up to two years. Global stock markets fell on 24 February due to a significant rise in the number of COVID-19 cases outside China. On 27 February, due to mounting worries about the coronavirus outbreak, U.S. stock indexes posted their sharpest falls since 2008, with the Dow falling 1,191 points (the largest one-day drop since the financial crisis of 2007–08) and all three major indexes ending the week down more than 10 percent. On 28 February, Scope Ratings GmbH affirmed China's sovereign credit rating but maintained a negative outlook. Stocks plunged again due to coronavirus fears, the largest fall being on 16 March. Many consider an economic recession likely.

Lloyd's of London has estimated that the global insurance industry will absorb losses of US$204 billion, exceeding the losses from the 2017 Atlantic Hurricane season and 9/11. The COVID-19 pandemic will likely be the costliest disaster in human history.

Tourism is one of the worst affected sectors due to travel bans, closing of public places including travel attractions, and advice of governments against travel. Numerous airlines have cancelled flights due to lower demand, and British regional airline Flybe collapsing. The cruise line industry was hard hit, and several train stations and ferry ports have also been closed. International mail between some countries stopped or was delayed due to reduced transportation between them or suspension of domestic service.

The retail sector has been impacted globally, with reductions in store hours or temporary closures. Visits to retailers in Europe and Latin America declined by 40 percent. North America and Middle East retailers saw a 50–60 percent drop. This also resulted in a 33–43 percent drop in foot traffic to shopping centres in March compared to February. Shopping mall operators around the world imposed additional measures, such as increased sanitation, installation of thermal scanners to check the temperature of shoppers, and cancellation of events.

Hundreds of millions of jobs could be lost globally. More than 40 million Americans lost their jobs and filed unemployment insurance claims. According to a United Nations Economic Commission for Latin America estimate, the pandemic-induced recession could leave 14–22 million more people in extreme poverty in Latin America than would have been in that situation without the pandemic.

Coronavirus fears have led to panic buying of essentials across the world, including toilet paper, dried and/or instant noodles, bread, rice, vegetables, disinfectant, and rubbing alcohol.

Governments across the country are spending unprecedented amounts in response to the COVID-19 pandemic. However, new spending is only making up a fraction of the damage the novel coronavirus is doing to the Canadian economy.

Parliamentary budget officer Yves Giroux's estimates that the various measures to help those affected by the pandemic will add up to nearly $146 billion in new federal government spending.

The Saskatchewan Experience

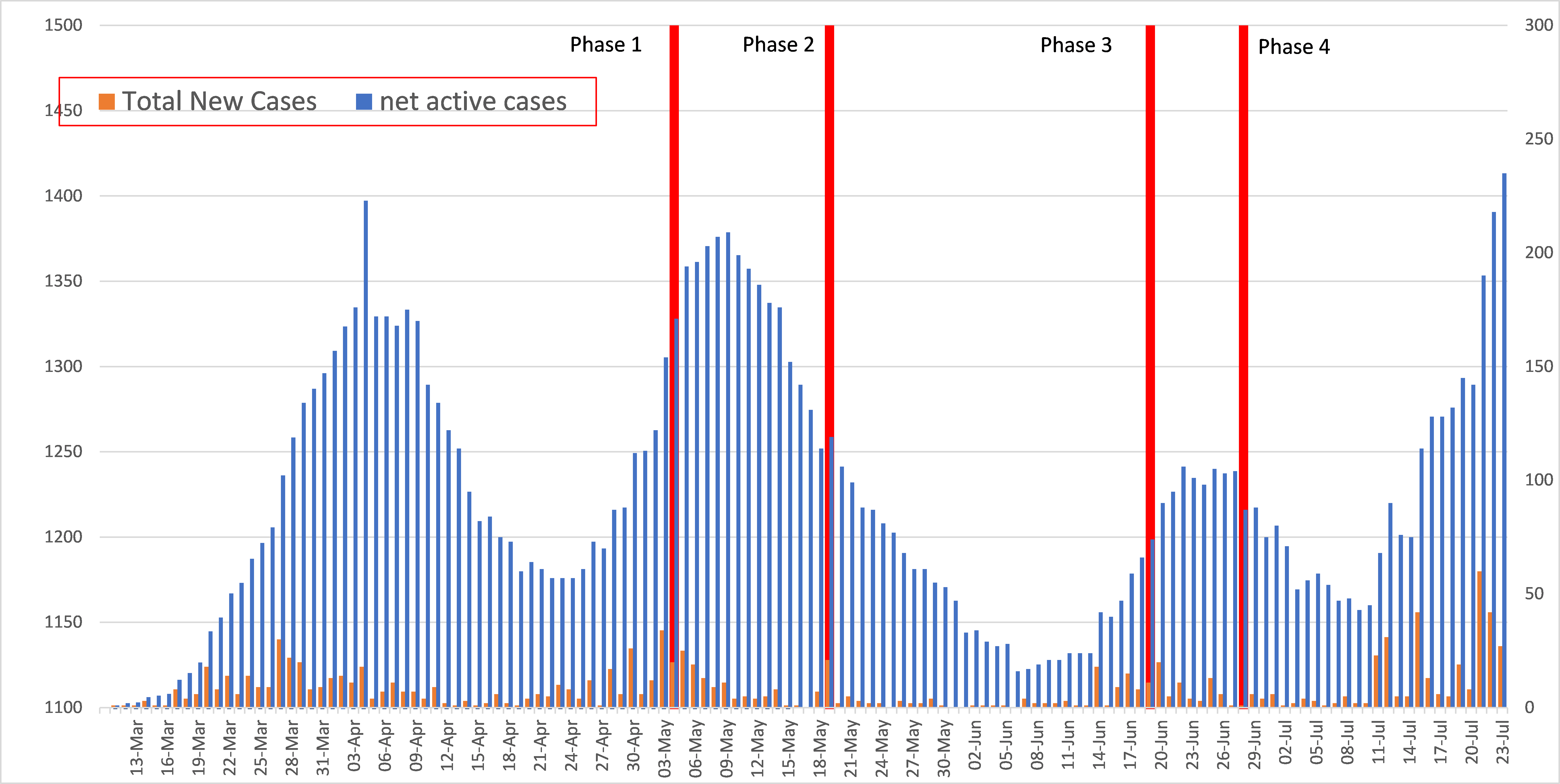

Data below shows Saskatchewan new cases and net active cases in relation to Re-Open Saskatchewan Phases 1 through 4.

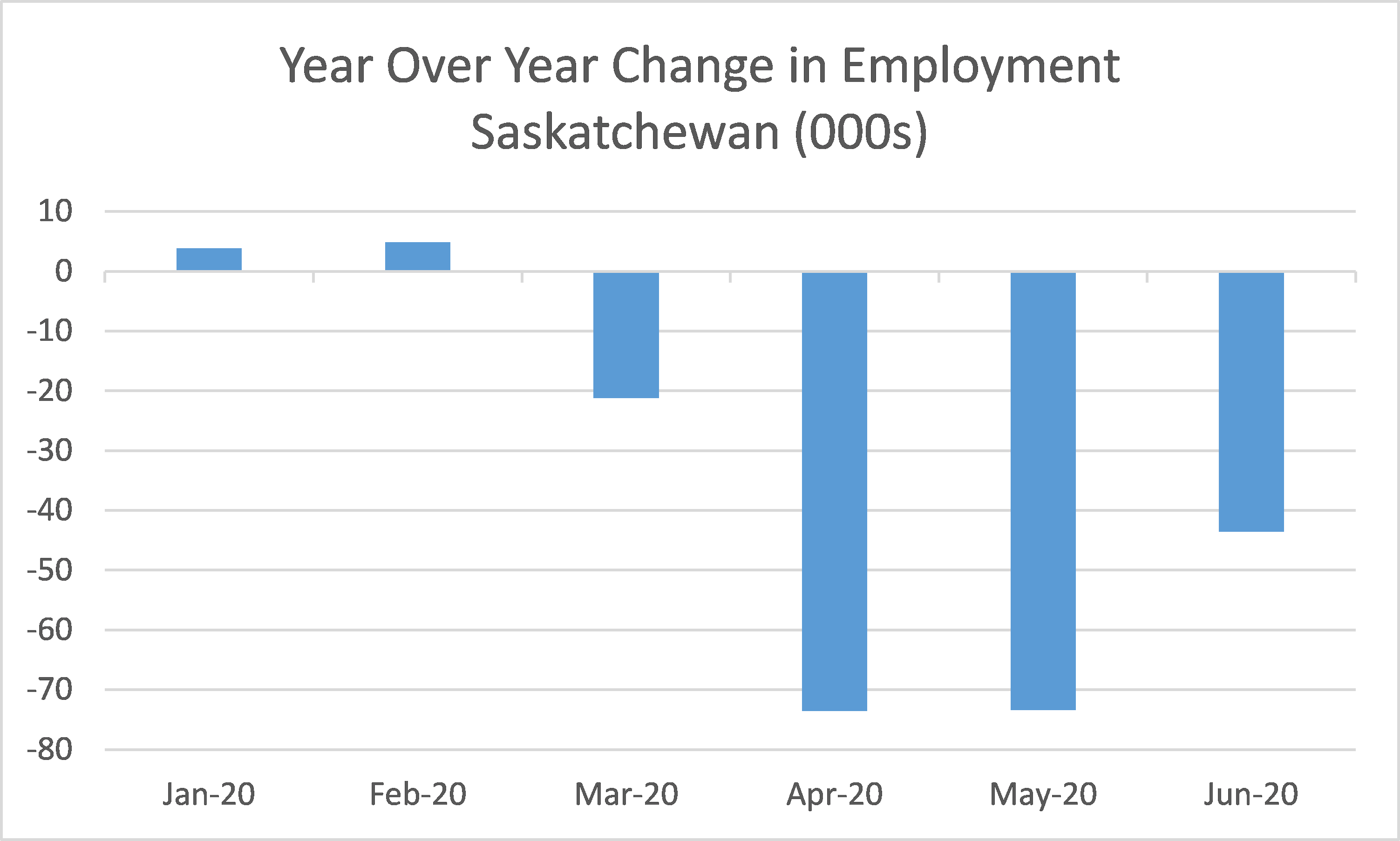

A recession is a period of temporary economic decline during which trade and industrial activity are reduced, generally identified by a fall in GDP in two successive quarters while a depression is defined as is a severe downturn that lasts several years. Quarterly GDP numbers are largely unavailable for Saskatchewan, however, monthly employment can be used as a proxy.

On a year over year basis (comparing to the same month 1 year ago), employment had been in decline since March 2020. In June 2020, the year over year decline was 22,400 positions with average year to date employment being down by 33,833 or -5.9% over the same period in 2019. As such, Saskatchewan is not yet in a technical recession.

By the end of March, a sequence of government interventions related to COVID-19, including the closure of non-essential businesses, travel restrictions, and measures directing Canadians to maintain social distancing, had been put in place. While so, job losses are expected to continue beyond the end of this month and into the remainder of 2020.

2020 employment by industry is estimated using the 2020 Q2 cumulative change in Provincial employment by industry applied to the remainder of the year resulting in a 5.9% decline in annual employment by the end of 2020.

Assuming that job losses continue throughout Q3 and Q4 2020, a likely case, the remainder of this analysis is focused on potential paths to recovery. Although the pandemic is completely unprecedented, an analysis of recovery patterns from the 1991-92 recession can be insightful. That recovery is characterized by a “U shaped” recovery, where employment growth slowly returned to previous levels, rather than having a quick rebound, a likely recovery scenario.

Select application of the 1992 to 1997 change rates to estimated 2020 employment by industry yielded a 5.9% increase in employment in 2021 or 2022. Timing of the recovery is entirely based on the discovery and dissemination of an effective vaccine which could be as far away as 2022. Until the introduction of a vaccine, it is expected that the current situation will be considered as the new normal with rolling travel restrictions and some lock down measures in place.

It should be noted that some industries (in red) will not likely bounce back and would stay at estimated 2020 levels: wholesale and retail trade, accommodation and food services, and transportation (through travel curtailment accelerating job losses through increased automation). Agriculture is expected to maintain job reductions tied to efficiency improvement and farm consolidation, and see a further 3.1% employment decline. Finally, government is expected to stay at 2020 levels as a public sector led job rally is not considered sustainable.

Implications for Business

The initial impact of the pandemic was greatest in the travel, entertainment and food service sectors. Sectors that rely on social interactions, non-essential spending and foreign sales have been particularly hard hit by COVID-19.

Sectors involving face-to-face personal services, such as hair salons and dental offices, have faced significant losses.

Commodity-producing firms dealing with lower global prices for resources continue to be heavily affected. This is especially true for the energy sector, which was facing challenges before COVID-19 emerged.

Sectors considered essential, those that were able to move easily to telework and those that could offer their services in a different way (such as virtual health care and grocery delivery) may not have felt the impact as deeply.

The pandemic affected regions and provinces differently because case numbers and containment measures varied across the country. The short and long-term effects on provinces may differ based on reliance on industries and sectors that have been significantly affected, for example, Atlantic Provinces that rely heavily on tourism, and western provinces with large energy sectors may have a slower recovery.

Ability to reduce the spread of COVID-19 impacts the capacity to reopen sooner: British Columbia, Manitoba, Saskatchewan and New Brunswick started easing restrictions first. This may bring about earlier improvements in consumer spending and confidence. But it could also make these provinces more vulnerable if there is a second wave of the virus. Ability to financially support their health-care systems, municipalities and public institutions such as universities and colleges depends on each province’s fiscal health.Moving Towards Recovery

Strong policy actions by the Bank of Canada, governments and other authorities have supported household incomes and helped businesses stay afloat through the lockdown period. This laid the necessary foundation for an eventual recovery.

The Bank lowered its policy interest rate to 0.25 percent to make it easier for people and businesses to manage their debt. The Bank has also put in place several programs to keep financial markets working.

Financial market conditions have improved significantly, and credit is continuing to flow to households and businesses when they need it most. These actions will ensure a well-functioning financial system to support the emerging recovery and will help Canada achieve its 2 percent inflation target.

Once measures to control the virus are relaxed, household spending and economic activity will start to rebound. But a full recovery to pre-COVID-19 levels of employment and output is unlikely in the short term.

Business will restart in stages, and people will gradually return to work. Bankruptcies or permanent closures will likely slow the recovery. Foreign demand and commodity prices will gradually increase as the global recovery gains traction.

Sectors that produce goods will likely recover sooner than face-to-face services. However, production lines may not operate fully in the short term because of supply chains interruptions.

The rebound in many service sectors (particularly travel, tourism and entertainment) will likely be tempered by ongoing concerns about large gatherings and close interaction.

Related Issues

This Issue's Economist:

TrendLine Saskatchewan is published monthly by Praxis Consulting.

Want TrendLine Saskatchewan Insights Focused on Your Business?

Now Available: Sector deep dives and customized economic reports designed to inform your business decisions.